Tool Kit

Options

An options contract gives the buyer the right to buy or sell a specified number of shares of a stock or ETF at a certain price (strike price) before a certain date (expiration). The total amount an investor pays for a singe options contract equals the price of the options (premium) times the options multiplier (generally, 100).

There are three primary uses of Options in a portfolio.

Generate Income

Speculation

Hedging

An option position is a wager on future price direction. A trader might think the price of a stock will go up or down, perhaps based on fundamental analysis or technical analysis. The trader then might buy the stock or buy an option on the stock. Speculating with an option—instead of buying the stock outright—is attractive to some traders since options provide leverage. An out-of-the-money call option may only cost a few dollars or even cents compared to the full price of a $100 stock.

Option Greeks

Delta

Delta measures how sensitive an option is to a $1 change in the price of the underlying asset.

Gamma

Delta measures how sensitive an option is to a $1 change in the price of the underlying asset.

Theta

Theta measures how sensitive an option is to time decay.

Vega

Vega measures how sensitive an option is to changes in the volatility of the underlying asset.

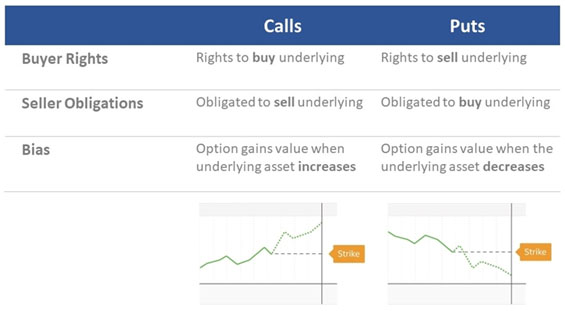

Call & Put Options

Call

Call options are financial contracts that give the owner Rights to BUY the underlying stock, bond, ETF, or other asset at a specified price within a specific time period. The stock, bond, ETF, or commodity is called the underlying asset. A call buyer profits when the underlying asset increases in price. A trader that “buys” a call is said to be long in their position and BULLish.

Put

Put options are financial contract that gives the owner Rights to Buy, to sell a certain amount of the underlying asset, at a set price within a specific time. The buyer of a put option believes that the underlying stock will drop below the exercise price before the expiration date. The exercise price is the price that the underlying asset must reach for the put option contract to hold value. A trader that “buys” a put is said to be long in their position and BEARish.

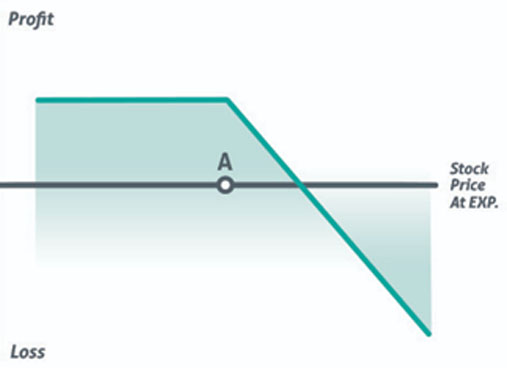

Short Call & Put

Short Call

A short call occurs when a trader opens an options trade by selling or writing a call option. The writer (short) of the call option receives a premium (option cost), and the profit on the trade is limited to that premium. A trader that “sells” a call is said to be short in their position, receives a premium, is Obligated to Sell the underlying position, and this is a BEARish position.

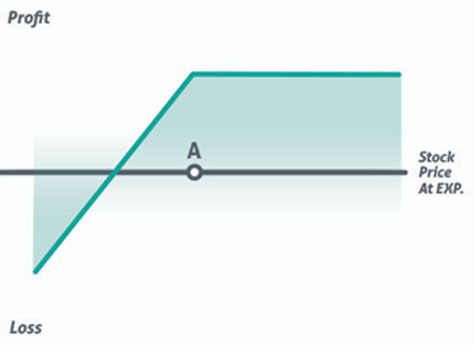

Short Put

A short put occurs when a trader opens an options trade by selling or writing a put option. The writer (short) of the put option receives a premium (option cost), and the profit on the trade is limited to that premium. A trader that “sells” a put is said to be short in their position, received a premium, is Obligated to SELL the underlying position, and this is a BULLish position.

Vertical & Diagonal Spreads

Vertical Spread

A vertical spread is used by investors who feel that the market price of an asset will go up or down (Bull or Bearish position) but wish to limit the reverse risk associated with an incorrect prediction. A vertical spread requires the simultaneous purchase and sale of options with different strike prices, but of the same class and expiration date. There are two types of vertical spreads – a call or a put. A vertical bull spread involves buying and selling call options, while a put spread involves buying and selling puts. The vertical spread looks to take advantage of a directional move, profiting from an anticipated directional move in the underlying security. The real advantage of a vertical spread is the downside is limited. Still, the upside remains limited.

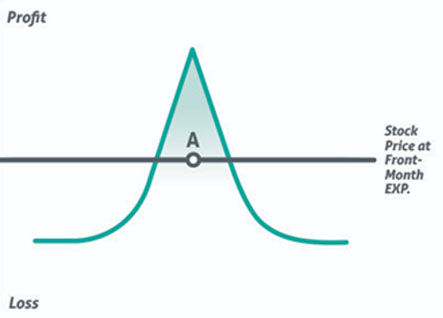

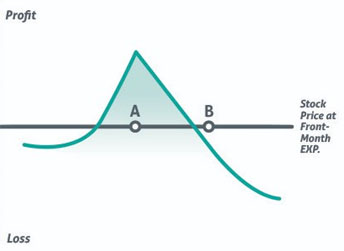

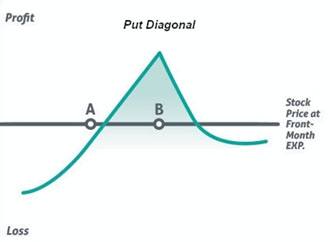

Diagonal Spread

A diagonal spread is an options strategy established by simultaneously entering a long and short position in two options of the same type (two call options or two put options) but with different strike prices and different expiration dates. Typically, these structures are on a 1 x 1 ratio and can lean bullish or bearish, depending on the structure of the options. A diagonal spread combines a horizontal spread, also called a time spread or calendar spread, which represents the difference in expiration dates, with a vertical spread, or price spread, which represents the difference in strike prices. The names horizontal, vertical, and diagonal spreads refer to the positions of each option on an options grid. Options are listed in a matrix of strike prices and expiration dates. Therefore, options used in vertical spread strategies are all listed in the same vertical column with the same expiration dates. Options in a horizontal spread strategy use the same strike prices but are of different expiration dates. The options are therefore arranged horizontally on a calendar. Most diagonal spreads refer to long spreads and the only requirement is that the trader buys the option with the longer expiration date and sells the option with the shorter expiration date. This is true for call strategies and put strategies alike.

The idea is that a trader wants to sell upside calls (collecting a premium and reducing net cost) but remains long and safe to accumulating profits with the upside momentum.If executed correctly, the trader can continue to sell upside calls against their long further out call. So, when one short-term call expires, the trader can sell another short-term call, set to expire in the following month, and can continue to do this up until the final month, when the long call is set to expire.